- Subscribe to RSS Feed

- Mark Discussion as New

- Mark Discussion as Read

- Pin this Discussion for Current User

- Bookmark

- Subscribe

- Printer Friendly Page

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 26 2020 01:44 PM

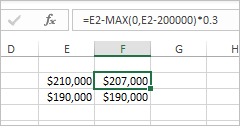

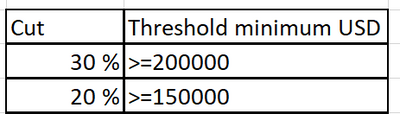

Hi, how do I calculate salary cut by 30 % only for the salary value which for example is USD 210.000? The cut is to be calculated only for amount equal or exceeding the USD 200.000 value, not for the whole salary.

- Labels:

-

Formulas and Functions

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 26 2020 01:52 PM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 26 2020 03:38 PM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 26 2020 04:21 PM

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 27 2020 04:06 AM

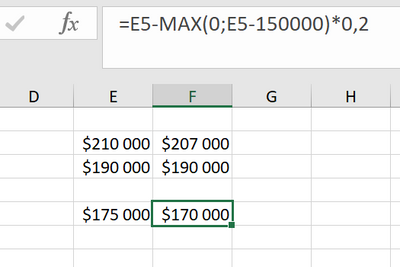

@SergeiBaklan thank you for your answer once again! I am still a bit confused because of this.

What will be salary cut for 200.000 USD salary? Salary cut is applied to amount equal or higher than 200.000 USD.

If I understand it correct for 175.000 USD the cut would be calculated (25.000 USD*20%), or as you write:

But what do I do when the salary is equal to threshold?

I really appreciate your answer! Thank you once again!

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 27 2020 04:17 AM

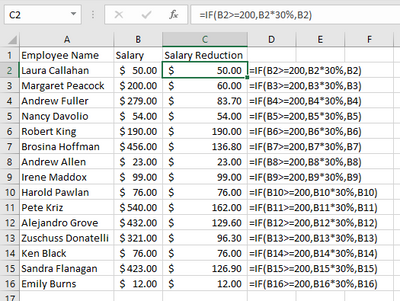

@Abiola1 thank you for answer.

It looks like this reduction is for the whole initial salary, not only the amount exceeding the threashold of 200. Maybe I was not clear enough: the salary reduction is not for the whole salary, but only for the amount equal or exceeding 200. For example for 250 salary the reduction is applied only for 50 USD.

But what happens to the salary which is exactly 200.000 USD? How the cut should be calculated in this case?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 27 2020 02:05 PM

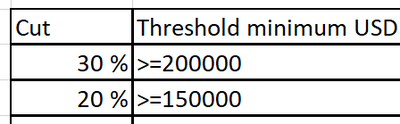

Sorry, I'm not familiar with these rules, could you please give entire picture? Formula depends on this. First question was about 30% from the top of 200K. Now it looks like 20% from the top of 150K till 200K PLUS 20% from above 200K. Does that mean 0% from any sum below 150K?

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 27 2020 02:19 PM

Thank you so much for your time!

Best regards,

Dalia

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 27 2020 03:50 PM

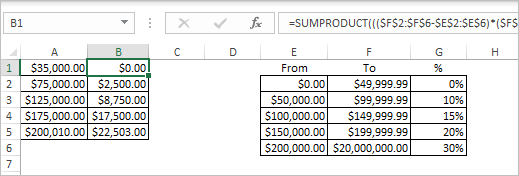

SolutionDalia,

It's better to create helper range with parameters

as in the right site of this screenshot. Actually it could be at any place within workbook. Formula in B1 could be

=SUMPRODUCT((($F$2:$F$6-$E$2:$E$6)*($F$2:$F$6-A1<0)+(A1>$E$2:$E$6)*(A1<$F$2:$F$6)*(A1-$E$2:$E$6))*$G$2:$G$6)drag it down.

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 29 2020 11:42 PM

@SergeiBaklan thank you so much for your help! It worked great:)

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Jun 05 2024 03:34 AM - edited Jun 05 2024 03:35 AM

To calculate a 30% salary cut on amounts exceeding USD 200,000 for a USD 210,000 salary, subtract 200,000 from 210,000 to get 10,000. Then, apply the 30% cut to 10,000, which is 3,000. Subtract this from 210,000, resulting in a final salary of 207,000. For more complex calculations, consider using a UIF calculator.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Mute

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Mar 27 2020 03:50 PM

SolutionDalia,

It's better to create helper range with parameters

as in the right site of this screenshot. Actually it could be at any place within workbook. Formula in B1 could be

=SUMPRODUCT((($F$2:$F$6-$E$2:$E$6)*($F$2:$F$6-A1<0)+(A1>$E$2:$E$6)*(A1<$F$2:$F$6)*(A1-$E$2:$E$6))*$G$2:$G$6)drag it down.