- Home

- Microsoft Teams

- Microsoft Teams Blog

- Empower frontline workers in financial services with Microsoft Teams

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

The role of the frontline worker is not only unique within financial services, but also rapidly evolving. From the universal bankers helping customers with home loans to the claims adjusters assessing damage after a storm, frontline workers oversee broad and increasingly diverse responsibilities. Across banking, insurance, and capital markets, they are expected to be more knowledgeable and responsive than ever before. Asked to prioritize customer satisfaction without losing focus on business outcomes, frontline workers have an important role in financial organizational success—making the employee experience a critical consideration in financial services.

At Microsoft, we know that responding to industry-wide change starts with an investment in an organization’s greatest asset: their employees. Today we’re excited to share how Microsoft 365 for Frontline and Industry and Microsoft Cloud for Financial Services are empowering financial services professionals with new tools and features so they can stay one step ahead of evolving expectations and industry demands.

Provide the tools to achieve more with less

Exceeding customer expectations in financial services requires effective and accelerated teamwork. Yet challenges like adapting to hybrid work and breaking down information silos often impede productive collaboration. Now, more than ever, providing access to the right people, resources, and information at the right time is critical for achieving success in the modern workplace.

Improved communication and collaboration for financial services workers on the frontline is just the beginning of what’s possible with Microsoft Teams. With chat, emails, calls, and file-sharing capabilities, frontline workers can more effectively and efficiently communicate with colleagues and customers. Coupled with a clear view into workloads with Tasks, frontline employees can stay on track and better prioritize their day. These are just a few solutions that can help connect disjointed experiences and streamline workflows across an organization.

TD Securities’ is one example of a company that was able to improve teamwork regardless of location and physical space with Teams—click here to read their story.

Improve employee satisfaction through empowerment, accessibility, and inclusion

Amid unprecedented levels of burnout and turnover, successful organizations understand that a positive employee experience—one imbued with a sense of purpose and opportunities for professional development—is critical. In fact, 62% of financial services workers say that a positive employee experience improves their ability to perform customer-facing tasks [1]. Microsoft Viva helps address the complex and multi-faceted needs of the frontline workforce.

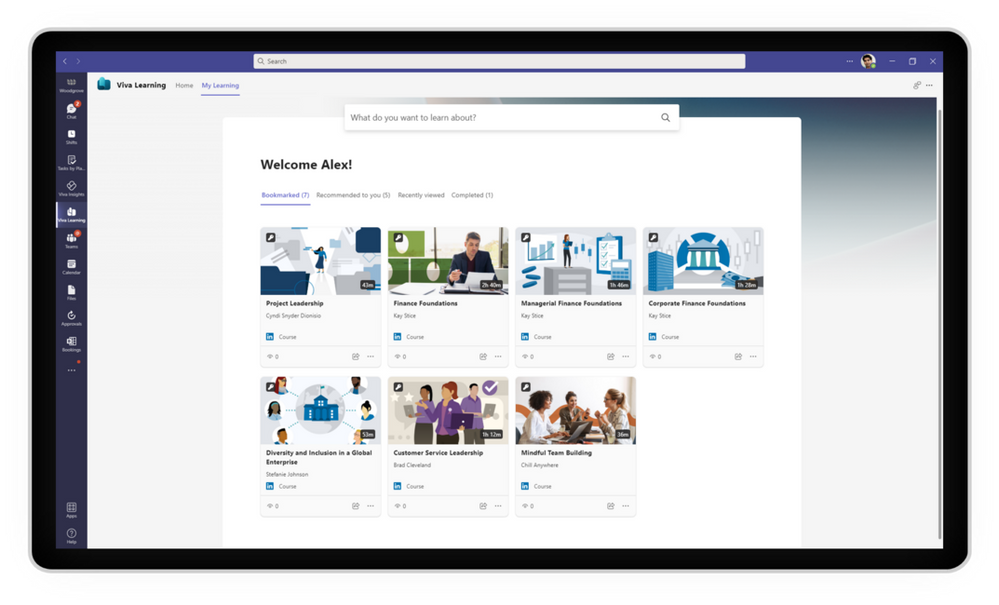

Microsoft Viva has several capabilities that benefit frontline workers. From improving productivity and wellbeing with Viva Insights to supporting a wide range of industry-specific learning content with Viva Learning, there is something for everyone. Building a supportive and inclusive workplace that enables diverse ideas, networks, and skillsets sets frontline workers—and financial services institutions—up for success.

Increase efficiency and agility across financial services organizations

Another common problem impacting financial services organizations is the abundance of manual and repetitive tasks that can limit employee productivity and distract them from higher-value, customer-facing work. With a finite number of hours in the day to get everything done, simplifying and streamlining workloads is key to reducing costs and improving workforce efficiency.

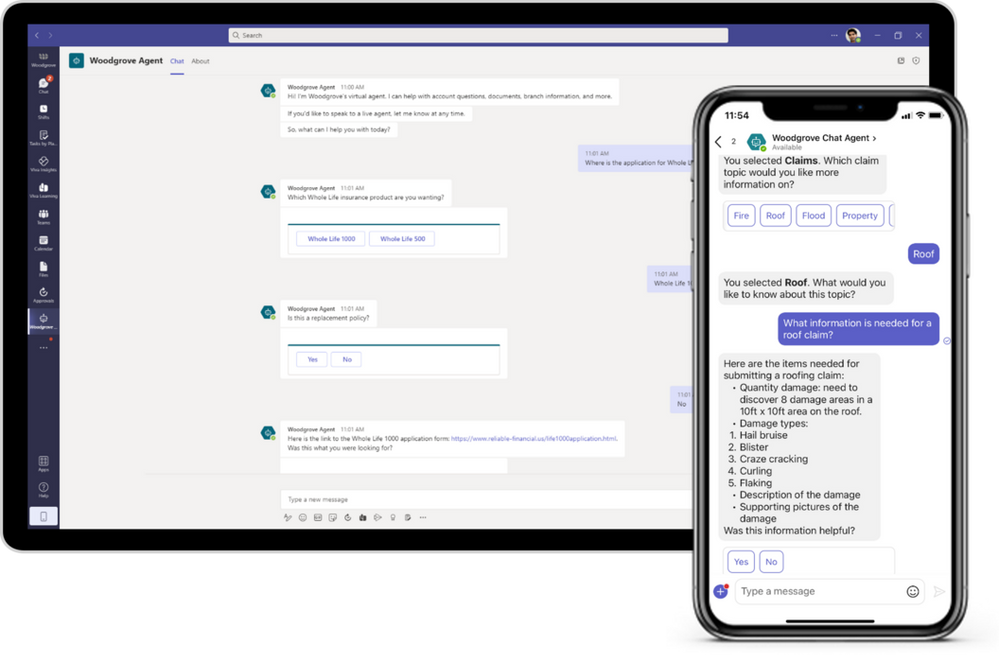

Automating fragmented tasks and processes is one way to promote greater efficiency and solve financial services’ unique business challenges. In fact, McKinsey asserts that 75-80% of transactional tasks and nearly 40% of strategic tasks can be automated across financial services [2]. Microsoft is equipped to help streamline both complex and mundane tasks so frontline workers can achieve more during the workday, providing solutions ranging from inline Approvals, task management, intelligent bots, and end-to-end workflows.

For insurers, underwriting and claims are some of the most complex and labor-intensive processes. The Hanover Insurance Group leveraged Power Platform to create an intelligent chatbot that quickly connect agents with the right underwriter for a particular business unit—click here to read their story.

Support deeper, more meaningful virtual connections with customers

While technology is often the key to unlocking new revenue sources and efficiency, workers often face unique pain points when it comes to client meetings like loans and investment advisory. Sometimes clients forget to attend meetings or security restrictions complicate the client experience.

To deliver frictionless, personalized, and consistent business-to-customer experiences, Virtual Appointments helps organizations build deeper, more meaningful connections between workers and the customers they serve. With Virtual Appointments, employees can facilitate a seamless customer experience that allows clients to receive text reminders and join custom branded virtual appointments through their mobile devices. Scheduling administrators are enabled to set-up and manage scheduled and on-demand virtual appointments in one location with advanced capabilities like appointment queuing and pre-appointment chat capabilities*. And organizations can measure business outcomes and improve business-to-customer engagements with rich analytics and reports.

Available today as part of Microsoft 365 and Office 365 licenses, you can start using basic capabilities that makes it easy for customers to join their appointment through a mobile web browser and easy to schedule a B2C meeting through Bookings. Want to learn more about the features and capabilities of Virtual Appointments? Check out the announcement here.

Advanced Virtual Appointments features will begin to rollout in December as a part of Teams Premium public preview, with general availability of Teams Premium in February. Want to learn the latest updates about Teams Premium, including public preview and general availability? Sign up to get updates here.

*2-way waiting room chat coming soon

Additionally, Virtual Appointments can complement the scheduling capabilities of intelligent appointments, a feature now available as part of Microsoft Cloud for Financial Services. By combining Virtual Appointments and intelligent appointments, financial institutions not only get a great virtual meeting experience, but all the functionality needed to facilitate efficient and meaningful virtual or in-person meetings.

Help protect personal, financial, and organizational data

Finally, a concern that is top-of-mind for every financial services organization is data security and compliance. Financial institutions are dually tasked with navigating a complex compliance landscape while also monitoring, mitigating, and addressing risk in the face of more frequent and sophisticated financial crimes.

Rest easy knowing that all Microsoft solutions are built with trust, security, and compliance in mind, including the Microsoft Cloud for Financial Services, which now incorporates the full Compliance Program for Microsoft Cloud. Moreover, Microsoft is prepared to help safeguard sensitive information across all an organization’s devices and endpoints.

Learn more about how Microsoft can help build the future of financial services

Learn more about Microsoft’s solutions that connect, protect, and empower frontline employees with Microsoft Frontline Worker productivity tools and the Microsoft Cloud for Financial Services.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.